Noida: In a significant development, Dr. Sandeep Marwah, a distinguished international media personality and President of Marwah Studios, has been nominated to the advisory board of Bhartiya Sanskriti Vaishvik Nyas (BSVN). This strategic collaboration aims to leverage Dr. Marwah’s wealth of experience in films, television, and media to further the objectives of the organization.

Expressing their enthusiasm about this partnership, Deepak Singhal, IAS Retd., former Chief Secretary UP and Convenor of BSVN, stated, “We are delighted to join hands with Dr. Sandeep Marwah, Chancellor of AAFT University of Media and Arts, and bring him on the advisory board of Bhartiya Sanskriti Vaishvik Nyas. His vast experience in films, television, and media will bring new light to the organization.”

Dr. Sandeep Marwah expressed his honor at working with experts who are veterans in their fields, particularly in Indian history and culture. He emphasized the commitment to unveiling truths and facts about Indian history and culture, leaving no stone unturned in the process.

Bhartiya Sanskriti Vaishvik Nyas, with Dr. Sandeep Marwah now on its advisory board, sets forth broad objectives to create a global platform for aggregating knowledge related to Bharatiya Sanskriti. The organization aims to counter false narratives that seek to demean Bharatiya Sanskriti, promote and disseminate Bharatiya Gyan among the masses, find solutions from Indic Knowledge systems for contemporary civilizational problems, and address immediate and foundational issues faced by Bharat and/or the world.

Prof. Kapil Kapoor, Dr Manohar Shinde, Dr. Sachidanand Joshi, Prof. Chaman Lal Gupta, Prof. Jagbir Singh, Prof. Sudhir Kumar, Prof. Rajnish K Mishra, Dr. Neerja A Gupta, Prof. Dr. Shashi Balaa, Prof. Baiidyanath Labh and Dr. Subroto Gangopadhyay are already on the board.

This collaboration is poised to bring together expertise and insights from various domains to contribute meaningfully to the preservation, promotion, and global understanding of Bharatiya Sanskriti.

Distinguished Media Figure Dr. Sandeep Marwah Appointed To Advisory Board Of Bhartiya Sanskriti Vaishvik Nyas

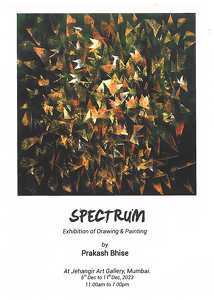

From: 5th to 11th December 2023

“SPECTRUM”

Solo Show of Drawings & Paintings by veteran artist Prakash Bhise

VENUE:

Jehangir Art Gallery

161-B, M.G. Road

Kala Ghoda, Mumbai 400 001

Timing: 11am to 7pm

Contact: +91 98206 06283

Veteran Artist Prakash Bhise Unveils “Spectrum” Exhibition at Jehangir Art Gallery

Prakash Bhise, a distinguished alumnus of the renowned JJ School of Art, is set to captivate art enthusiasts with his latest exhibition, “Spectrum,” at the Jehangir Art Gallery. Running from December 5th to the 11th 2023, the showcase promises a visual feast of approximately 48 abstract paintings, marking Bhise’s significant contribution to the world of art over his four-decade-long career.

A veteran Artist and former professor at the Raheja School of Art, Bhise’s artistic journey has been a dynamic exploration of styles, with a transition to abstract art in 2000. His keen awareness of social issues, cultivated through years of activism, finds expression on canvas, making his artwork a commentary on the human experience.

Notable in his repertoire is a painting series inspired by the poetry collection “Golpitha” by renowned poet Namdev Dhasal, earning acclaim for its depth and resonance. Bhise’s artistic prowess extends beyond national borders, with exhibitions in Germany, Holland, and Bangladesh showcasing his talent to an international audience.

The “Spectrum” exhibition is a testament to Bhise’s commitment to pushing artistic boundaries. His abstract paintings, while defying conventional understanding, reflect a two-dimensional quality inspired by India’s traditional miniature painting legacy. Bhise attributes this unique style to the intense sunlight in India, emphasizing lines and shapes on canvas.

Art lovers attending the exhibition can anticipate a liberal use of colors, creating an immersive experience that transcends traditional artistic analysis. Bhise believes that abstract art is not meant to be dissected but experienced, offering glimpses into his life experiences and philosophy.

Prakash Bhise consider himself fortunate to receive training under the guidance of esteemed professors, including Prof. Sambhaji Kadam, Prof. Vishwanath Solapurkar, Prof. Prabhakar Kolte, Prof. Mrugank Joshi, Prof. Paul Koli, Prof. S K Lagate, Prof. Vasant Sonawane and others during his time at the prestigious JJ School of Art.

Trained under the guidance of Dean Prof. Shankar Palashikar sir at JJ School of Art, Bhise seamlessly navigates between realistic and abstract styles, evoking overwhelming emotional responses from viewers. His command of color, brushwork, and medium creates a captivating drama on canvas, reflecting a nearly four-decade-long artistic journey.

The “Spectrum” exhibition serves as a canvas of life experiences, exploring diverse textures and themes such as human emotions, nature’s beauty, and the direct impact of global events, including the Ukraine-Russia war.

Watch Video On Youtube

https://www.youtube.com/shorts/sJMhNZOdywo

SPECTRUM Solo Show of Drawings & Paintings by veteran artist Prakash Bhise in Jehangir

फ़िल्म निर्देशक प्रमोद शास्त्री जब भी कोई फ़िल्म बनाते हैं तो उन फिल्मों में पारिवारिक रिश्तों की अहमियत देखते ही बनती है। वे हर फ़िल्मों में परिवार के मार्मिक रिश्तों को सलीके से प्रस्तुत करते हैं। प्रमोद शास्त्री निर्देशित भोजपुरी फ़िल्म ‘दत्तक पुत्र’ के ट्रेलर में पिता पुत्र का भावनात्मक रिश्ता देखने को मिल रहा है। प्रभु श्रीराम की नगरी अयोध्या की पृष्ठभूमि पर बनाई गई यूनिक स्टार यश कुमार व विनोद मिश्रा स्टारर भोजपुरी फिल्म ‘दत्तक पुत्र’ के ट्रेलर की हर कोई प्रशंसा कर रहा है। इसमें दर्शाया गया है कि किसी भी रिश्ते की बुनियाद मन की भावनाओं पर टिकी होती है। पिता और बेटे का रिश्ता अनमोल होता है। फिल्म ‘दत्तक पुत्र’ की कहानी एक ऐसे पिता पुत्र की भावनात्मक रिश्ते पर आधारित है, जो अपने दत्तक पुत्र को बहुत प्यार करता है और उस पर अटूट विश्वास करता है। प्रोड्यूसर विनोद गुप्ता और निर्देशक प्रमोद शास्त्री की जोड़ी में बनी सम्पूर्ण पारिवारिक सुपरहिट फिल्म आन बान शान ने जहाँ सफलता का परचम लहराया है, वहीं फ़िल्म दत्तक पुत्र के ट्रेलर ने सबका ध्यान खींच लिया है। इसमें दत्तक पुत्र की भूमिका में यश कुमार और पिता के किरदार में विनोद मिश्रा ने कमाल का अभिनय किया है। स्टार एक्ट्रेस शुभी शर्मा ने लाजवाब अदायगी किया है। वहीं प्रमोद शास्त्री के निर्देशन की खूब तारीफ की जा रही है। यह ट्रेलर वर्ल्डवाइड रिकॉर्ड्स भोजपुरी के ऑफिसियल यूट्यूब चैनल पर रिलीज किया गया है। ट्रेलर को लाखों की तादात में व्यूज मिले हैं।

मीडिया में सवाल के जवाब में फिल्म दत्तक पुत्र के निर्देशक प्रमोद शास्त्री ने कहा कि ‘हमारी फिल्म की कहानी अयोध्या की गालियों की है। जब से अयोध्या में विकास तेजी से बढ़ा है वहां की जमीनें बहुत महंगी हो गई है और जमीन की लालच में आकर लोग रिश्ते को भूलते जा रहे हैं। बाबू जी की जमीन लोग जरदस्ती कब्जा करने की कोशिश करते हैं। जो पुत्र बिना पिता का पैर दबाए नहीं सोता है, उस पर पिता की हत्या के इल्जाम में फंसा दिया जाता है। किस तरह से नायक सिद्ध करता है कि जरूरी नहीं खून के ही रिश्ते ही बहुत अच्छे होते हैं। अपने पिता का विश्वास कभी उसके ऊपर से टूटने नहीं देता है।’

एबी5 मल्टीमीडिया बैनर के तले बनी सम्पूर्ण पारिवारिक भोजपुरी फिल्म ‘दत्तक पुत्र’ के निर्माता विनोद कुमार गुप्ता हैं। निर्देशक प्रमोद शास्त्री हैं। पटकथा व संवाद एस.के. चौहान ने लिखा है। डीओपी जगमिंदर सिंह हुंदल (जग्गी), संगीतकार आज़ाद सिंह, राम प्रवेश ठाकुर, कोरियोग्राफर संजय कोर्वे, एक्शन मास्टर दिनेश यादव, आर्ट डायरेक्टर प्रमोद गुडयानी, एडीटर प्रकाश झा हैं। बैकग्राउंड म्यूजिक मनोज सिंह ने दिया है। साउंड डिज़ाइनर संजय आर दास, एचओपी अरशद खान, लाइन प्रोड्यूसर आनंद आर श्रीवास्तव, कार्यकारी निर्माता अरशद खान, पब्लिसिटी डिजाइनर शक्ति आर्ट नरसू हैं। म्यूजिक राइट्स वर्ल्डवाइड रिकॉर्ड्स भोजपुरी के पास है। फ़िल्म के मुख्य कलाकार यश कुमार मिश्रा, शुभी शर्मा विनोद मिश्रा, देव सिंह, शैलेन्द्र श्रीवास्तव, समर्थ चतुर्वेदी, मनीष चतुर्वेदी, राधे खान, ग्लोरी मोहन्ता, बबलू खान, शिवेश तिवारी, रुबेश यादव हैं।

प्रमोद शास्त्री की फ़िल्म ‘दत्तक पुत्र’ के ट्रेलर को मिला लाखों आडियंस का प्यार

Mumbai, 2nd Dec, 2023 – Director-Producer Jaiprakkash Shaw orchestrated a dazzling affair at the Grand Music Launch of the upcoming film ‘Love Karu Yaaa Shaadi’ produced by Happyzon Telefilms & Auro Film Production. The spotlight shone on the much-anticipated songs “Wedding Da Season” and “Petha Agre Ka,” enchantingly composed by SLF and penned by the prolific Shabbir Ahmed.

A star-studded ensemble, including the film’s debutant actors Akarsh Alagh, Misha Kapoor, Mairina Singh, and Prity Singhania, took center stage. Adding allure to the event were the stunning performers of the film’s item song, Kinnari Dama and Preeti Goswami, whose presence added an extra layer of glamour to the celebration.

Ace Choreographer Shabina Kkhan’s magic was palpable as the dance sequences unfolded, accompanied by the melodious voices of Swati Sharma, Pranav Singhal, Pawni Pandey, and Mellow D, who lent their vocals to the soul-stirring tracks.

The star-studded affair also saw the presence of industry veterans and actors, including Ali Asgar, Govind Namdev, Garima Agarwal, Happy Sharma, Manoj Bakshi, and music composer Sanddep Nath. Media representatives were treated to an exclusive screening of both songs, immersing themselves in the rhythm and energy of the compositions.

Director-Producer Jaiprakkash Shaw expressed, “I have always believed in mentoring and introducing new talents in my films. This project is a testament to the amalgamation of modern thinking with traditional cultures, weaving a narrative that resonates emotionally with audiences. The film, from its storyline to its soulful music, connects with the heartstrings of every viewer.”

The media and audience alike have showered immense appreciation on both songs, predicting them to be the season’s biggest wedding hits. ‘Love Karu Yaaa Shaadi’ promises to be a cinematic symphony that transcends boundaries, capturing the essence of love and celebration.

LOVE KARU YAAA SHAADI Promises To Be A Cinematic Symphony That Transcends Boundaries, Capturing The Essence Of Love And Celebration.

Tax planning is a crucial aspect of running a successful business. For startups and entrepreneurs, understanding the intricacies of tax laws and regulations can make a significant difference in their financial health and overall success. In this article, we will explore the importance of tax planning for startups and entrepreneurs, including how it can help in fund raising, business planning, and navigating the complexities of the tax system.

* The Role of Tax Planning in Fundraising

When it comes to raising funds for your startup, having a solid tax plan in place can greatly enhance your chances of success. Investors and lenders often require a clear understanding of the financial aspects of your business, including its tax obligations. By demonstrating your tax planning strategies, you can instill confidence in potential investors and lenders, showing them that you have a comprehensive plan to manage and optimize your tax liabilities.

A well-crafted tax plan can also help you determine the amount of funding you need and how it will be allocated. By considering the potential tax implications of different funding scenarios, you can make informed decisions about debt financing, equity financing, or a combination of both. This level of financial foresight can impress potential investors and provide them with the assurance that their investment will be utilized effectively.

* Incorporating Tax Planning into Business Planning

A business plan is a roadmap that outlines your vision, goals, and strategies for success. It is essential to include tax planning as an integral part of your business plan. By doing so, you can ensure that your financial projections accurately reflect your tax obligations and that you have allocated sufficient resources to meet those obligations.

When developing your business plan, consider the tax implications of different business structures. For example, forming a limited liability company (LLC) or a corporation can provide certain tax advantages and asset protection. On the other hand, a sole proprietorship may be simpler to set up but could expose you to personal liability for business debts.

Additionally, tax planning should be incorporated into your sales and pricing strategies. Understanding the tax implications of different pricing models and sales channels can help you optimize your revenue and profitability. By factoring in taxes from the outset, you can avoid surprises and ensure that your pricing strategy aligns with your overall financial goals.

* Navigating the Complexities of the Tax System

The tax system can be complex and ever-changing, making it challenging for startups and entrepreneurs to stay compliant and maximize tax savings. Engaging with tax professionals who specialize in working with startups and entrepreneurs can provide invaluable guidance and support.

Tax professionals can help you identify eligible tax credits, deductions, and incentives specific to your industry and business activities. They can also assist in structuring your business transactions and operations in a tax-efficient manner. By staying informed about the latest tax regulations and leveraging expert advice, you can minimize your tax burden while remaining in full compliance with the law.

* Goods and Services Tax (GST) Considerations

For startups and entrepreneurs involved in the sale of goods or services, understanding the implications of Goods and Services Tax (GST) is essential. GST is a value-added tax levied on most goods and services sold for domestic consumption. It is crucial to determine whether your business is required to register for GST and comply with its reporting and payment obligations.

Proper GST planning involves understanding the thresholds for registration, the applicability of different GST rates, and the availability of input tax credits. Failing to comply with GST regulations can result in penalties and reputational damage. Therefore, it is vital to stay informed about your GST obligations and seek professional advice when necessary.

Conclusion –

Tax planning is a critical aspect of running a successful startup or entrepreneurial venture. By incorporating tax planning into your fundraising efforts, business planning, and overall financial strategy, you can optimize your tax liabilities, minimize risks, and position your business for long-term success.

Remember to seek the guidance of tax professionals who specialize in working with startups and entrepreneurs. They can provide the expertise and support needed to navigate the complexities of the tax system, ensure compliance, and identify opportunities for tax savings. With proper tax planning, you can focus on growing your business and achieving your entrepreneurial goals with confidence.

For more detail Visit: www.cadunia.com

The Importance Of Tax Planning For Startups And Entrepreneurs By CA DUNIA

Tax planning is a crucial aspect of running a successful business. For startups and entrepreneurs, understanding the intricacies of tax laws and regulations can make a significant difference in their financial health and overall success. In this article, we will explore the importance of tax planning for startups and entrepreneurs, including how it can help in fund raising, business planning, and navigating the complexities of the tax system.

* The Role of Tax Planning in Fundraising

When it comes to raising funds for your startup, having a solid tax plan in place can greatly enhance your chances of success. Investors and lenders often require a clear understanding of the financial aspects of your business, including its tax obligations. By demonstrating your tax planning strategies, you can instill confidence in potential investors and lenders, showing them that you have a comprehensive plan to manage and optimize your tax liabilities.

A well-crafted tax plan can also help you determine the amount of funding you need and how it will be allocated. By considering the potential tax implications of different funding scenarios, you can make informed decisions about debt financing, equity financing, or a combination of both. This level of financial foresight can impress potential investors and provide them with the assurance that their investment will be utilized effectively.

* Incorporating Tax Planning into Business Planning

A business plan is a roadmap that outlines your vision, goals, and strategies for success. It is essential to include tax planning as an integral part of your business plan. By doing so, you can ensure that your financial projections accurately reflect your tax obligations and that you have allocated sufficient resources to meet those obligations.

When developing your business plan, consider the tax implications of different business structures. For example, forming a limited liability company (LLC) or a corporation can provide certain tax advantages and asset protection. On the other hand, a sole proprietorship may be simpler to set up but could expose you to personal liability for business debts.

Additionally, tax planning should be incorporated into your sales and pricing strategies. Understanding the tax implications of different pricing models and sales channels can help you optimize your revenue and profitability. By factoring in taxes from the outset, you can avoid surprises and ensure that your pricing strategy aligns with your overall financial goals.

* Navigating the Complexities of the Tax System

The tax system can be complex and ever-changing, making it challenging for startups and entrepreneurs to stay compliant and maximize tax savings. Engaging with tax professionals who specialize in working with startups and entrepreneurs can provide invaluable guidance and support.

Tax professionals can help you identify eligible tax credits, deductions, and incentives specific to your industry and business activities. They can also assist in structuring your business transactions and operations in a tax-efficient manner. By staying informed about the latest tax regulations and leveraging expert advice, you can minimize your tax burden while remaining in full compliance with the law.

* Goods and Services Tax (GST) Considerations

For startups and entrepreneurs involved in the sale of goods or services, understanding the implications of Goods and Services Tax (GST) is essential. GST is a value-added tax levied on most goods and services sold for domestic consumption. It is crucial to determine whether your business is required to register for GST and comply with its reporting and payment obligations.

Proper GST planning involves understanding the thresholds for registration, the applicability of different GST rates, and the availability of input tax credits. Failing to comply with GST regulations can result in penalties and reputational damage. Therefore, it is vital to stay informed about your GST obligations and seek professional advice when necessary.

Conclusion –

Tax planning is a critical aspect of running a successful startup or entrepreneurial venture. By incorporating tax planning into your fundraising efforts, business planning, and overall financial strategy, you can optimize your tax liabilities, minimize risks, and position your business for long-term success.

Remember to seek the guidance of tax professionals who specialize in working with startups and entrepreneurs. They can provide the expertise and support needed to navigate the complexities of the tax system, ensure compliance, and identify opportunities for tax savings. With proper tax planning, you can focus on growing your business and achieving your entrepreneurial goals with confidence.

For more detail Visit: www.cadunia.com

The Importance Of Tax Planning For Startups And Entrepreneurs By CA DUNIA

Jashn Agnihotri is a model and actress. She has worked in many Punjabi films, TV and print advertisements, webseries and Hindi films and is doing many more projects. She has worked in many music albums. Recently, she was also seen in a music album with actor Shreyas Talpade. She shared her experience of working with Shreyas Talpade that he is a greatly skilled actor, he does not require many retakes and he is also expert in his work. It was a pleasure to work with such an experienced actor and learn new things from him.

Jashn Agnihotri has appeared in a song of Madhur Bhandarkar’s film Indu Sarkar.

Her Hindi film ‘Kaisi Yeh Dor’ is going to be released soon. The trailer of the film has been launched. This is a film that understands the true meaning of relationships and family. Jashn’s character is playing the lead in this film. At the beginning of the film she is a bubbly, happy-go-lucky kind of a person. This film is based on a small town and in the ups and downs of the film’s story, there is a change in her personality and in the end she becomes evolved and serious. There are many shades in her character. The film has been shot in Uttar Pradesh and Maharashtra. The shooting of the film took place during peak winter season in UP which was not very easy yet very exciting .

Before coming into the film industry, Jashn was an air hostess and used to travel from Delhi to Mumbai on flights. Jashn Agnihotri tells that she never thought that she would one day become a part of the film industry but fate pulled her in this direction. She belongs to Delhi and was working as an air hostess when people from film industry on a flight from Delhi to Mumbai suggested her to try her luck in acting. She liked the suggestion and came to Mumbai and gave a few auditions. She liked Mayanagari very much and after some time she decided to stay here and become a part of it, at first taking baby steps into modeling and then finally acting. Jashan loves watching films, reading and learning new things and languages. Her favorite actors are Shahrukh Khan and Aamir Khan. She has received Best Actress Award for the Punjabi film ‘Thappa’. She has also received the Indu US Cultural Ambassador award. She has many awards in her list of awards.

Jashn says that films influence people in a big way & that they have an impact on people’s lives in some way or the other. Therefore, she wants to do films which give a good message to the people and impact their lives positively .

Jashn says that people are moving away from their family and culture. Earlier it was so pleasant to live in a joint family, people were bound by their traditions and culture, but now everyone is moving away from their loved ones and their culture. A person should never forget the importance of his roots. External appearances are just an illusion which will fade away one day.

Actress Jashn Agnihotri Hindi Film Kaisi Yeh Dor Is To Be Released Very Soon

This Event is attributed to the Memory of Dharti Aaba Bhagwan Birsa Munda.

This Event is Organized by PRADHANMANTRI ATMANIRBHAR BHARAT ABHIYAN SANGHATHAN Presented by CHILDREN WELFARE CENTRE COLLEGE OF LAW.

Prominant Personalities and Speakers who are proficient in their respective fields will participate in this National Debate on how our Country of BHARAT is marching towards the destination of a Progressive Nation and how every Citizen can contribute their bit to the acceleration and prosperity of our Nation and how we collectively can give momentum to strengthen the Leadership of our Prime Minister Shri Narendra Modiji who has a vision to also take together the Janajatia Community of Bharat in this March of Progress. The Janajatiya Community has a significant role in the Freedom Movement of Our Country.

Unity in Diversity has always been our Countrys Forte and we do have several challenges to be met. This thought process will prove a guideline to the younger Generation of our Nation is the thought of the National Spokesperson of Shri PREM KUMAR of PRADHANMANTRI ATMANIRBHAR BHARAT ABHIYAN SANGHATHAN.

With this Event we will begin with providing a platform for the younger generation of our Country to which we look forward with lots of hope and expectation. Our Country of BHARAT will not only become MAHASHAKTI but will prove to be a MAHASATTA in this Mission of LEAD BHARAT 2036.

The Foundation is to be built by the entire Nation and the time is NOW, feels Prem kumar. Mumbai North Member of Parliament Shri Gopal Shetty ji is the Chief Guest of this Event who will speak his mind and give guidelines to us all.

Renouned Educationist, Social Worker, National Activist and Founder Trustee of Children Welfare Centres College of Law Shri Ajay Kaul ji, Shri Prashant Kashid, Pradhanmantri Atmanirbhar Bharat Abhiyan Sanghathan National President Shri Mukesh Sharma, Working President Shri Ramkumar Pal, Secretary Shri Bhavesh Joshi, Social Activist Sundari Thakur, Advocate Bindu Dube, BJP Leader Manoj Kumar Singh, International Rock Painter Shri Subodh Nemlekar , Businessman Shri Pawan Kumar, Journalist Shri Arun Lal , Businessman Shri Chand Seth, Educationist Shri Shamsher Rahi, Businessman and Social Activist Shri Pankaj Soni, Advocate Akhilesh Dube and Advocate Shri V K Dubey, Dr. Amulya Sahu and others of the National Team has collectively attributed to the fulfillment of this National Event.

We are proud that The Chief Guest of Honour for this National Event is Graced by Nationally Renouned PIL MAN OF INDIA Shri ASHWINI KUMAR UPADHYAY who is the Supreme Court of INDIA Lawyer.

LODHA FOUNDATION Founder Smt. MANJU LODHA, Renowned Shri KRISHNA PRAKASH, IPS, ADG, MAHARASHTRA who is also Crowned with the Title of IRON MAN and ULTRA MAN Internationally, ADVOCATE, Shri PUNEET CHATURVEDI, Shri DEEPAK PANDEY, I.G MAHARASHTRA, BHAJAN SAMRAT ANUP JALOTA, ENTERPRENUERAL BJP LEADER SHWETA SHALINI and many such personalities will grace the Occasion.

BHARAT NATIONAL NEET 23 A Grand 3 Day Event in form of JANAJATIYA GAURAV DIVAS is being organized on 2nd, 3rd and 4th of December in Malad West.

Cheetah Yajnesh Shetty, Rakesh Anna Shetty & Dr Harish Bhujanga Shetty with galaxy of movie stars were present in this occasion 27th Nov. 2023 at Celebration Club at Lokhandwala Andheri. There is ChitahJKD celebrated 15th National Championship”. Sh. Shagoon Wagh enlighted the lamp. Shri Vithal Shetty Foundation Trophy” presented to the top 3 winners, awareness programe on” No to drug” in presence of Dr Harish Bhujanga Shetty “Governing Council National Institute of Social Defense , Ministry of Social Justice & Empowerment Govt of India .

Associate partner Rakesh Anna Shetty of Shri Vithal shetty Foundation is helping in educating under privileged children, supported by Kartik Kider.

Bollywood’s well-known Martial Arts Guru and Best Film Action Choreographer of the Decade Dr.Cheetah Yajnesh Shetty has also been honored with the degree of ‘Doctorate of Philanthropy (PhD) in Martial Arts Pure Science’ by the ‘Global Martial Arts University Grant Commission’. Cheetah Yajnesh Shetty has till now given martial arts training to more than 150 Bollywood stars and about 10 lakh women.

Cheetahjkd Celebrates Bruce Lee 83rd Birth Anniversary With Commando Hero Prem Parrijaa & Ashok Beniwal Dedicated To Educate Under Fc Privileged Children And Awareness On “No To Drug”

In the competitive and vibrant world of cinema, only talent can help you succeed in the long run. Proving her potential with immense talent, Indian film and television actress Christina Bali has been steadily making a name for herself, leaving a significant mark in the industry. Passionate to be in front of the camera, Christina has always loved to express herself to a larger audience.

Undoubtedly, her dedication to the art of acting has seen her progress in the entertainment world. With her roots in Delhi, Christina Bali completed her acting course at the Star Film & Academy in Mumbai back in 2017. While she completed her education in Delhi, and after earning a diploma degree, she moved to Mumbai, adding another layer to her diverse skill set by becoming a trained teacher.

Balancing her business pursuits, she found her true calling on the stage. It was then she joined a theatre group in Indore where she successfully showcased her acting skills by performing in numerous plays. It is known that the entertainment industry is a demanding arena, and Christina embodies the resilience required for success. Her dedication and passion for film and television have been the driving forces behind her journey.

As a TV artist, Christina has faced a myriad of challenges. However, she has made sure to improvise her skills and work hard on the craft of acting. One of the notable chapters in Christina’s career was when she seized the opportunity to work as a supporting artist in the film ‘Dream Girl 2’ sharing the screen with acclaimed actors Ayushmann Khurrana and Ananya Panday.

Collaborating on such a prominent project speaks volumes about her talent and the recognition she is garnering in the competitive industry. “The character length does not matter to me. What matters the most is how beautifully I portray my character on screen. I have always worked with utmost sincerity, and it helped me get a role as a supporting artist in such a big Hindi film”, reveals Christina.

With her work, Christina Bali is eventually becoming a noteworthy name in the industry. Earlier, she has featured in various shows, ads, and web series in diverse supporting and character roles. This versatile approach showcases her ability to breathe life into different roles, capturing the attention of audiences and industry insiders alike.

As she continues to scale new heights, Christina Bali remains focused on her acting career, with more exciting projects in her kitty. Watch out for Christina Bali as she is set to impress the audiences and contribute to the dynamic landscape of Indian film and television with multiple projects already in the pipeline.

Actress Christina Bali Shines Bright With Her Incredible Journey From Theatre To Tv And Cinema